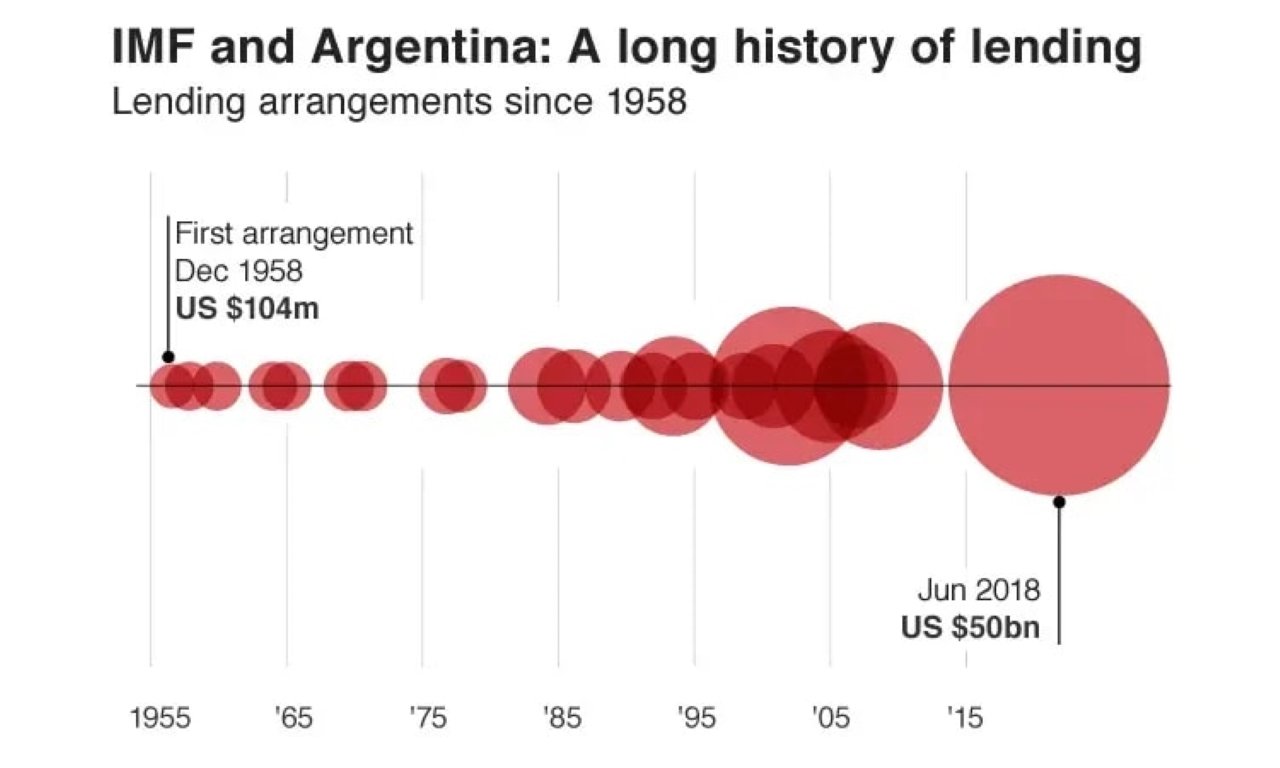

BUENOS AIRES, 12 April 2025 (BSS/AFP) – The International Monetary Fund has approved its 23rd loan agreement with Argentina—Latin America’s third-largest economy and the IMF’s largest borrower—further deepening a complex and often fraught financial relationship.

A $20 Billion Lifeline Amid Debt and Discontent

Argentina’s newly approved $20 billion loan comes atop an existing debt of approximately $40 billion owed to the IMF. This decision underscores the country’s long-standing reliance on external financing as it continues grappling with high inflation, fiscal instability, and periodic recession.

| Key Statistics | Figure |

|---|---|

| Number of IMF Loan Agreements | 23 |

| Total Outstanding IMF Debt | ~$40 billion |

| Latest Loan Approved | $20 billion |

| Projected Growth (2025 & 2026) | 5.0% annually (IMF) |

| Argentina’s Rank Among Debtors | #1 (ahead of Ukraine) |

Decades of Loans and Unmet Promises

1956: Argentina joined the IMF in September and received its first loan two years later in a bid to tame inflation and stabilise a weakening economy. Between 1958 and 1961, the country took three more loans, but the economic revival remained elusive.

Over the decades, IMF assistance was extended to successive regimes—whether democratic, military, left-wing, or right-wing—turning Argentina into a perennial client of the lender.

2001 Crisis: The Breaking Point

In 2001, Argentina defaulted on its IMF obligations in what became the largest sovereign default in the Fund’s history. Years of heavy borrowing culminated in a deep crisis that toppled the government of President Fernando de la Rúa. The “corralito” policy—restricting bank withdrawals—provoked widespread unrest, resulting in 39 deaths during mass protests.

The fallout tainted public perception of the IMF:

📊 55% of Argentines today view the institution negatively.

“IMF deals always bring austerity, and it’s the middle class and the poor who pay the price,” notes economist Noemí Brenta, who authored a book on Argentina’s debt cycle.

A Brief Reprieve

2006: Under leftist President Néstor Kirchner, Argentina fully repaid its IMF debt—around $9.8 billion—and distanced itself from the lender. For over a decade, no new loan agreements were signed.

2018: A Record and a Relapse

The respite ended in 2018, when President Mauricio Macri secured a record $57 billion IMF agreement—the largest in Fund history. However, only $44 billion was disbursed as the subsequent administration under Alberto Fernández rejected the remainder and sought renegotiation.

Despite lofty aims of stabilisation, the deal failed. The peso devalued, inflation soared, and Argentina slipped into deep recession. In 2021, the IMF admitted the programme had failed to restore confidence or stimulate growth.

A new Extended Fund Facility (EFF) was introduced in 2022 to refinance the prior commitment.

2023–2025: Milei’s Gamble with Austerity

After assuming office in December 2023, President Javier Milei, a self-described libertarian, returned to the IMF for fresh support. His economic reforms included severe spending cuts, aiming to:

-

Repay debts to the Central Bank

-

Contain inflation

-

Rebuild foreign currency reserves

Achievements so far:

| Indicator | Outcome |

|---|---|

| Inflation | Significantly reduced |

| Budget | First surplus in over a decade |

| Social Cost | Rising poverty, economy in recession |

Despite the initial economic pain, Milei has won IMF praise, with the Fund projecting 5% growth for 2025 and 2026, exceeding global averages.

Still Trapped in the Debt Cycle

According to Martin Kalos of the EPyCA consultancy, Argentina has only managed to repay interest on its 2018 debt and still owes $40 billion, which now increases to $60 billion with the new loan.

“Argentina faces many years of continuous negotiation with the IMF,” Kalos warned, highlighting that the country remains locked in a long-term cycle of borrowing and repayment.